At Regan Schiller & Associates Private Wealth Management, we provide investment strategies, estate planning, tax organization, and retirement preparation for the unique goals and financial aspirations of each of our clients.

We begin each client relationship with a genuine connection and honest discussion. The focal point of Regan Schiller & Associates Private Wealth Management is authentic relationships and exceptional client service. Our expertise falls considerably on high net-worth. Our experience with this exclusive group has given us an unmatched understanding of risk management strategies, investment opportunities, and tax knowledge for high-income clients.

Tax planning is a critical component of the financial plan for many clients. Tax minimization is an integral element for financial success. At Regan Schiller & Associates Private Wealth Management, we explore strategies to address primary financial needs, and ultimately achieve true financial well-being of each client.We take a unique, creative and strategic approach to managing, creating, and building your wealth.

Insurance Planning Approach

Cash and Liquidity Management

Estate Planning

Competitive Program Pricing

Competitive

We work to offer you the best financial advice combined with a competitive fee structure.

Transparent

Our proposed fee structure includes taxes and custodian costs.

Declining fee

Starting at $250,000, our fee structure decreases according to the level of assets invested.

Consolidation

Starting at $500,000, you can consolidate family assets into the same series (parents, children, grandparents, spouses).

Unbundled fees

Management and advisory fees are unbundled and allow for a tax deduction on advisory fees for nonregistered accounts.

Investment Planning Approach

Long-standing partnerships provide superior risk-adjusted returns

- We have access to some of the brightest international financial managers

- We will compliment your customized investment programs with niche solutions

- We carefully research and select asset managers that are likely to succeed

- We will identify and critique performance factors in the early stages of the process

- Established partnerships offer enhanced risk-adjusted returns

We use a disciplined approach to manage, advise and consult on your life plan.

Regan Schiller & Associates Private Wealth Management is committed to ensuring our clients get access to high-quality global asset managers. Together, we can pursue your goals and secure your financial future.

Retirement Planning

Your retirement plan should keep pace with your life

Regan Schiller & Associates Private Wealth Management carefully crafts a retirement plan that suits the pace of your lifestyle as it changes throughout the years.

We will design a customized, tax-efficient retirement strategy that enhances your life – instead of limiting it.

- Outline your life goals and objectives

- Customize a holistic life plan

- Measure your strategy by probability, not averages

- Review regularly and alter your plan when necessary

- Careful calculation of your retirement income and expenses

- Ensure you maintain asset stability

- Suggest investment opportunity and planning alternatives

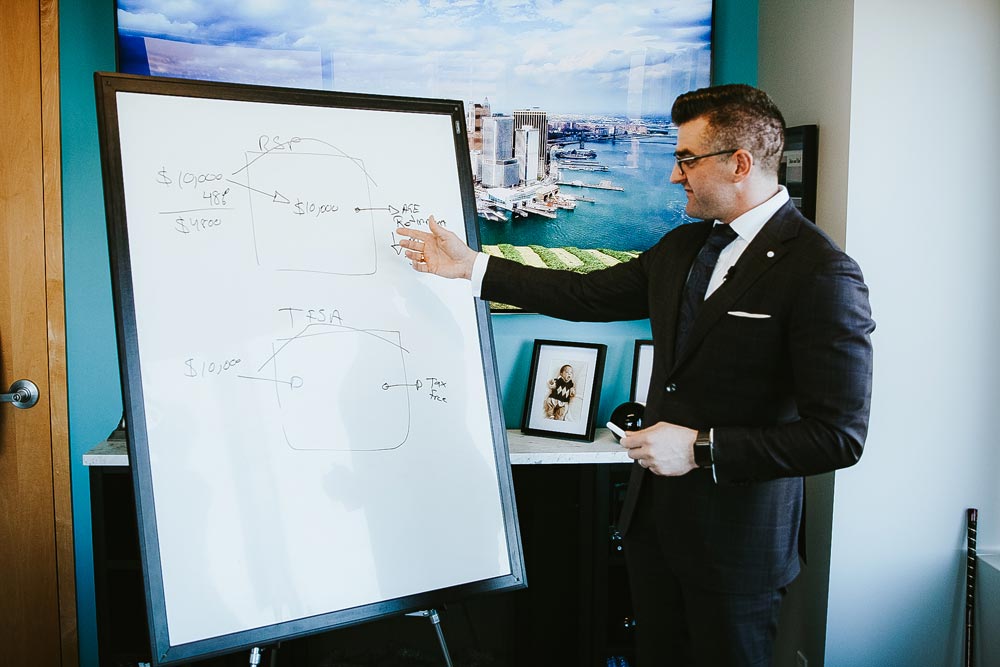

Tax Planning

-

Taxes are inevitable.

We are strategic in our planning, which not only achieves your financial goals, but will be tax efficient -

Unexpected deductions and/or credits.

Rely on a knowledgeable financial advisor to help you pay the least amount of taxes possible. -

Save for retirement.

Minimizing taxes and understanding government benefits will help your longterm financial plan -

Business planning.

The structure of your business can impact your tax deductions and credits – which ultimately affects your net income. Structure your business in a way that will be maximally beneficial. -

Remuneration strategies.

When deciding between salary or dividend compensation, it’s important to understand which strategy will help you maximize cash flow after taxes. -

Estate planning.

Plan for taxes payable upon death and incorporate these fees into your financial plan

Insurance Planning Approach

-

Alleviate future financial burden.

By conducting a thorough insurance needs analysis, we will assist you in determining your insurance requirements. By implementing a proper and customized insurance plan, we can help protect you and your family’s well-being. -

Estimate and understand risk.

Insurance goes beyond home insurance. It’s imperative to protect your family from an unforeseen loss of income. We will consider and compare life, critical illness and disability insurance. -

Protect your estate.

Insurance can give you the opportunity to accumulate additional savings – or leave more wealth to your loved ones -

Guaranteed income.

Life annuity may provide a foundation for your retirement income

Cash and Liquidity Management

-

Flexible strategies.

By being flexible with your wealth strategies, you will remain open to opportunities as they arise. -

Non-traditional cash strategies.

Your financial situation will change drastically as you age. Your IG Consultant will assist in implementing strategies that grow with you. -

Beneficial mortgage solutions.

A mortgage is often the biggest purchase of your life. Real estate can be an incredible investment and building block to your wealth strategy. -

Solutions Banking All-in-one.

We have the right credit and lending solutions to fit your life plan

Estate Planning

-

In order to provide a legacy and protect your family after your death, your estate has to be carefully planned

-

An estate plan is a multi-faceted and comprehensive outline

-

Your estate plan should be personalized to address your needs.

-

Your estate plan should distribute your assets carefully and clearly.

-

Your estate may be taxed at the time of your death. A proper estate plan will plan for tax.

Business Succession

- As a business owner, it’s important to know the requirements of transitioning your business. Regan Schiller & Associates Private Wealth Management can provide guidance on the difficult task of either outselling your business or passing it down the line.

- It must be determined whether you are eligible to access the lifetime capital gain

- Learn to minimize the amount of tax you must pay

Charitable Giving

- Having a charitable giving plan can is an important factor in a Private Wealth Management Strategy.

- First, you must determine what cause is most important to you. From there, Regan Schiller & Associates Private Wealth Management will help you establish the best ways to support your favourite charities. We will help develop a long-term approach to build you a lasting legacy.

- Carefully strategize the source of your donations. Depending on the source and time of your giving, you may be eligible for more savings

Intergenerational Wealth Planning

-

It is more difficult to plan intergenerational wealth planning than ever. Cost of living has increased, as has average life span. It may be more complex when planning the proper way to pass down your legacy.

- With Regan Schiller & Associates Private Wealth Management, we will consult on topics such as inheritance, legacy, wills, business succession and estate planning.

Engaging you on your progress

Online Access

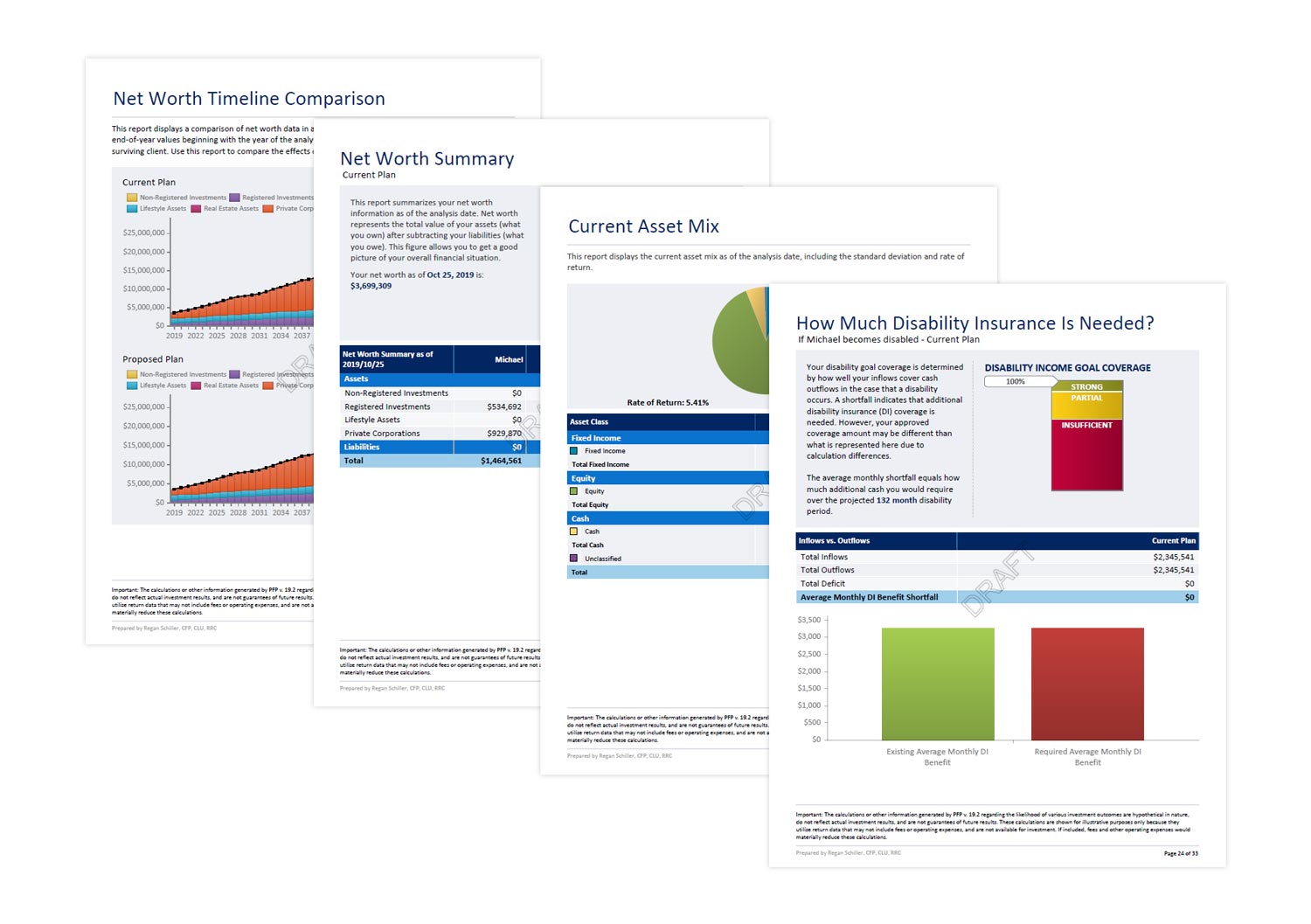

Professional Financial Plan